-

Sword

Learn More -

Prescription Drug

Learn More -

Health Savings Account (HSA)

Learn More -

Telemedicine

Learn More -

Health Care and Limited Purpose Flexible Spending Account

Learn More -

Dependent Care Flexible Spending Account

Learn More -

Short Term Disability

Learn More -

Long Term Disability

Learn More -

Critical Illness Insurance

Learn More -

Hospital Indemnity Insurance

Learn More

WHAT IS A HEALTH SAVINGS ACCOUNT (HSA)?

- A Health Savings Account is a bank account tied to a High Deductible Health Plan (HDHP). An HSA enables Wedgewood employees to pay for current health expenses and save for future qualified medical expenses on a tax-free basis.

- To enroll in an HSA, you must be enrolled in a HDHP. Wedgewood offers a HDHP as its Base Plan option, which allows employees to contribute to an HSA.

- Employees can make pre-tax payroll contributions of up to $4,300 if they have individual coverage, or up to $8,550 if they have family coverage.

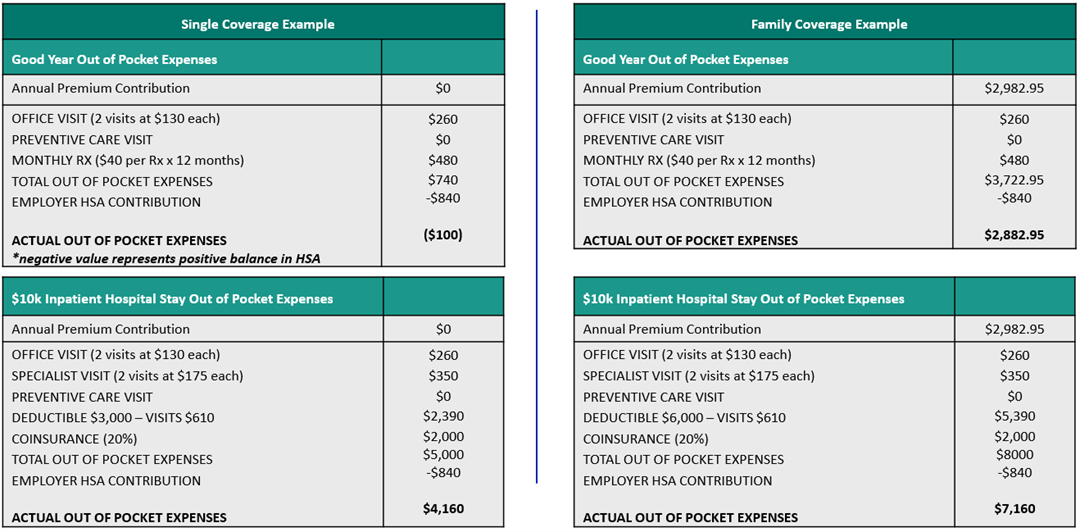

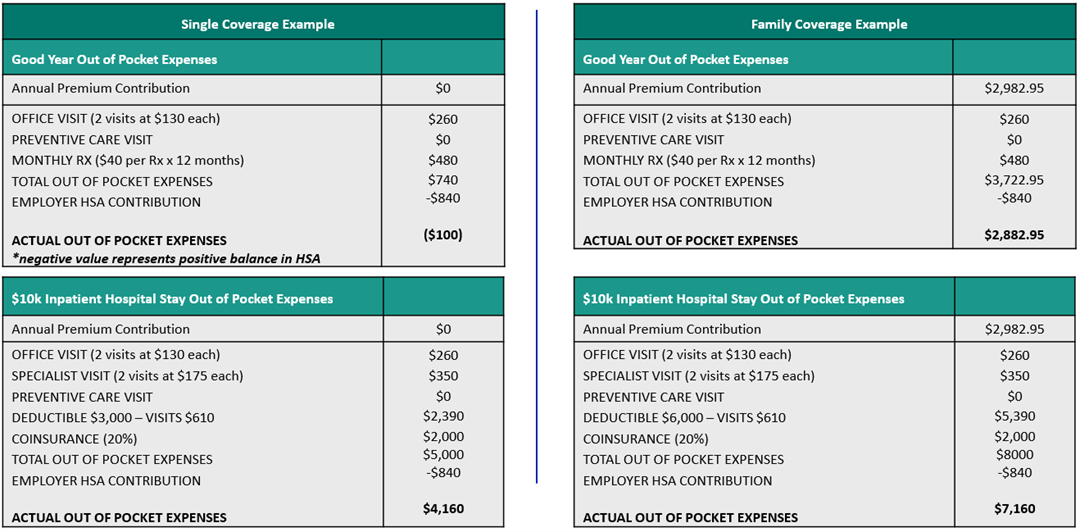

- Wedgewood will fund $840 annually into employees’ HSA accounts. HSA’s will be funded $70 per month.

HOW DOES A HEALTH SAVINGS ACCOUNT WORK?

- All employees enrolled in a High Deductible Health Plan will receive a debit card which will provide access to the account to use the funds for any “Qualified Medical Expense”.

- The Meritain HDHP’s Health Savings Account (HSA) will be administered through Inspira.

- The Kaiser HDHP’s HSA will be administered through WEX Health and Healthcare Bank.

- Employees’ unused funds will accrue interest on a tax-free basis which rollover from year to year.

- Employees have the option to choose their preferred bank for their investment opportunities.

WHO IS ELIGIBLE FOR A HEALTH SAVINGS ACCOUNT?

Wedgewood employees are eligible to open an HSA if they are:

- Covered by the HSA-qualified High Deductible Health Plan (HDHP) option.

- Not covered by other health insurance that is not a HDHP (including a plan your spouse or parent may have where he/she has selected family coverage.)

- Not enrolled in an FSA (unless limited benefit) or an HRA.

- Not enrolled in Medicare Part A or Part B or Medicaid, Tricare (Military Health System)

- Have not used your VA Benefits at any time during the previous three months

- Not eligible to be claimed as a dependent (child) on another’s tax return.

DO ALL “QUALIFIED” EXPENSES APPLY TO MY MEDICAL PLAN?

No, under the IRS rules for Health Savings Accounts, many additional expenses are HSA-qualified but are not covered by medical plans.

-

Contribution deadline

A Health Savings Account is paired with your high deductible health plan. It allows you to set aside money on a before-tax basis for eligible medical expenses you have now, or you can save it to use for qualified medical expenses in the future (even after you retire). Allows you to build a medical nest egg. Contributions, earnings and withdrawals are tax-free as long as you use the funds for qualified medical expenses.

2025 limits: $4,300/individual; $8,550/family (based on who you cover under the medical plan). You can update or change your contribution amount at any time within the IRS annual limits.

-

Unused funds carry over?

HSAs are intended to help you prepare for future medical expenses. Contributions, investment earnings and withdrawals are tax-free if used for qualified expenses.

Yes.

-

Can I track my account online?

You are responsible for opening and managing your account with an HSA trustee or bank. You own it, not your employer.

Yes, at https://inspirafinancial.com

-

What expenses are eligible?

Generally, eligible expenses include medical, prescription drug, dental and vision deductibles, copays and your portion of coinsurance; COBRA premiums; long-term care premiums; qualified expenses for your dependents. A complete list can be found at www.irs.gov, Publication 502

See www.irs.gov, Publication 502 or 969.

-

Does an HSA affect my taxes?

Your contributions are tax-free. Contributions your employer makes (if any) do not affect your income. You must file Form 8889 when you file taxes to disclose your contributions for the year.

Yes; you are required to file Form 8889 to disclose your contributions. Speak with your HSA trustee for details or see www.irs.gov, search Publication 969.

Inspira HSA Vendor - Meritain HDHP Base Plan

Provider: Meritain HDHP Base Plan

Website: https://inspirafinancial.com/

-

Contribution deadline

A Health Savings Account is paired with your high deductible health plan. It allows you to set aside money on a before-tax basis for eligible medical expenses you have now, or you can save it to use for qualified medical expenses in the future (even after you retire). Allows you to build a medical nest egg. Contributions, earnings and withdrawals are tax-free as long as you use the funds for qualified medical expenses.

2025 limits: $4,300/individual; $8,550/family (based on who you cover under the medical plan). You can update or change your contribution amount at any time within the IRS annual limits.

-

Unused funds carry over?

HSAs are intended to help you prepare for future medical expenses. Contributions, investment earnings and withdrawals are tax-free if used for qualified expenses.

Yes.

-

Can I track my account online?

You are responsible for opening and managing your account with an HSA trustee or bank. You own it, not your employer.

Yes, at https://www.wexinc.com

-

What expenses are eligible?

Generally, eligible expenses include medical, prescription drug, dental and vision deductibles, copays and your portion of coinsurance; COBRA premiums; long-term care premiums; qualified expenses for your dependents. A complete list can be found at www.irs.gov, Publication 502

See www.irs.gov, Publication 502 or 969.

-

Does an HSA affect my taxes?

Your contributions are tax-free. Contributions your employer makes (if any) do not affect your income. You must file Form 8889 when you file taxes to disclose your contributions for the year.

Yes; you are required to file Form 8889 to disclose your contributions. Speak with your HSA trustee for details or see www.irs.gov, search Publication 969.

-

Click To Download Plan Documents:

WEX HSA Vendor - Kaiser HDHP Base Plan

Provider: Kaiser HDHP Base Plan

Website: https://www.wexinc.com/

Benefits & Resources